For a monthly fee, you can have an identity theft protection company help keep your personal information safe. On the most basic level, the business will monitor your credit and alert you when potential issues arise.

Having this type of monitoring is a great option that can give you peace of mind. However, this level of protection doesn’t help prevent issues, it only alerts you after they occur.

When you work with the right identity theft protection company, you’ll get warnings, monitoring, alerts and recovery. Warnings are important, as they can tip you off to essential tips, like the importance of freezing your credit files at Equifax.

Monitoring keeps an eye on your personal information and makes sure it doesn’t fall into the wrong hands. Alerts can notify you of when the worst happens, like someone who’s not you opens a bank account in your name.

Recovery is the final component of protection that can help you recover lost money and ultimately undo the damage that’s created when your personal information is stolen.

Fraud is a huge problem worldwide that affects countless adults each year. There’s now more technology use than ever before, and cyber crimes are rising in numbers, too. Thieves like to use phishing emails, social media scams and traditional hacking methods to steal personal data.

If you shop online, you put yourself at more of a risk than the average user. Criminals know how to steal your payment information and then use your information as their own.

Additionally, with so much online banking, hackers can now do more harm than ever before. If they want, they have the power to deposit and write checks, move money between your accounts and open new accounts in your name.

For these reasons and more, identity theft services are paramount and should be sought out by every individual who uses a computer or WiFi-enabled device regularly, especially those that use technology while aging in place.

A Special Demographic

Identity theft influences many ages, but there’s one group that has a particularly hard time with its occurrence … each year, 2.6 million seniors are victims of identity theft.

Interestingly enough, not all attacks come from an internet user at first. As you age, you’re more likely to have caregivers who help you in some capacity. These individuals often have a lot of access to your home and your personal property.

Before you invite someone into your home, consider running a background check on them to ensure they’re trustworthy. If you’re not comfortable requesting a background search, make sure you look out for suspicious behavior and conduct.

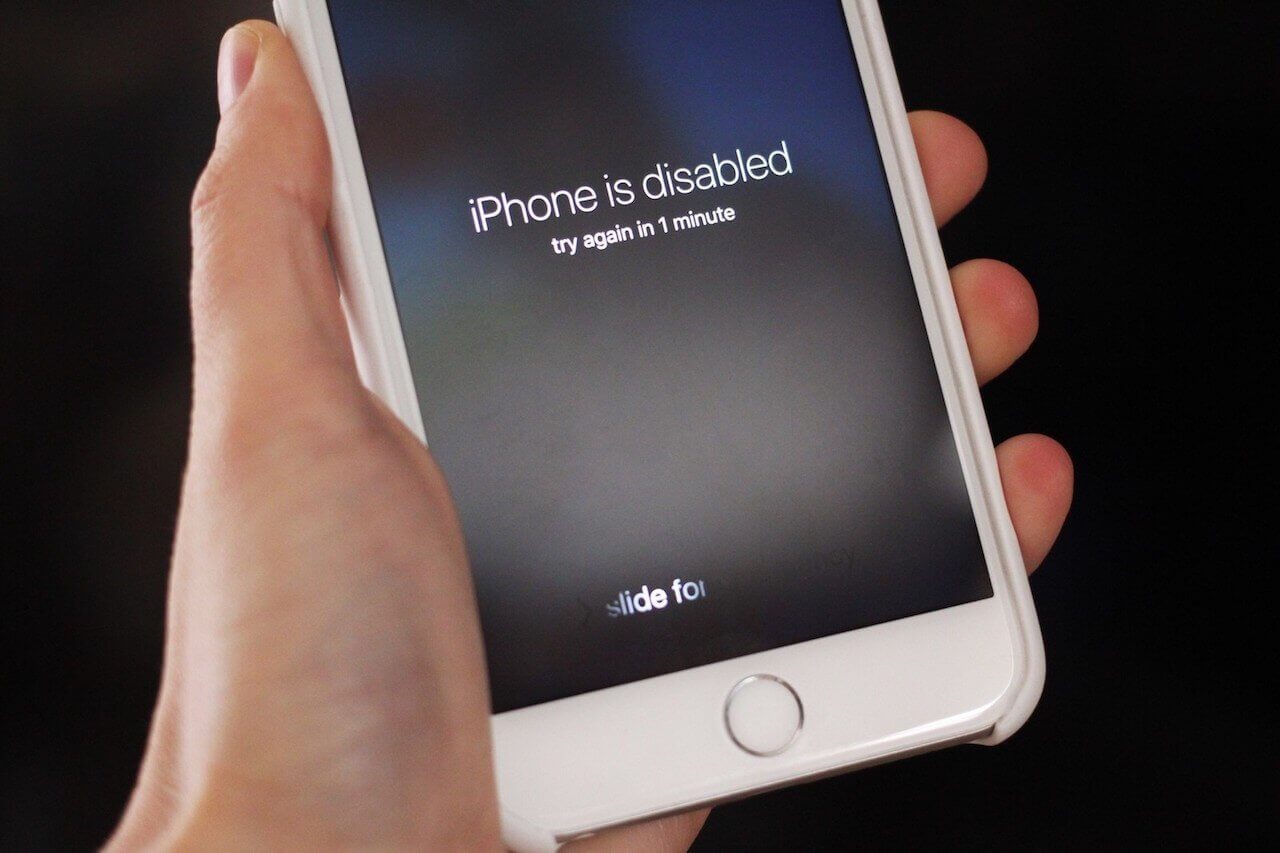

Whenever your helper is over, try to keep all important documents that contain your personal information locked away. More importantly, lock your devices with unique passcodes that only you know. People who have access to your computer can do a lot of damage, so you want to make sure you keep your digital information locked away.

Another smart step to take is to familiarize yourself with common scams. Although there is innovation in online criminal activities, some methods remain the same as time passes. Make sure you’re aware of historically popular scams so you can spot them when they come up.

The IRS publishes a “ Dirty Dozen” list each year that can tip you off to the most common and current scams people are experiencing. For example, in 2017, phishing emails, phone scams, identity theft, return preparer fraud and fake charities were the five most common types of tax scams.

The Bad Guys

Nearly everyone has wondered who steals identities at some point in life. Although suspects change, there are a few common groups who are generally to blame when it comes to identity theft.

Corrupt programmers are one such group. These individuals are known for writing codes for viruses that infect your computer and wreak havoc on your system. A hacker generally uses a malicious website or link to trick you into downloading his or her virus in order to take advantage of you.

Those who steal credit and debit card information are also common subjects who are sometimes called carders. Once they have your bank account info, they might use it to make purchases of their own. They’ve also been known to sell card information on the black market.

Criminal hackers, also called black hat hackers, look for weaknesses in networks.

Once they’ve found a vulnerability, they exploit it to harm as many people as possible. Although this group generally attacks networks of computers, like in a company’s office, they will sometimes attack individuals.

Timing Is Everything

Of course, the best time to get identity theft protection services is before an adverse event occurs. That being said, many people don’t know about theft protection services or choose not to use them until they’re a victim of identity theft.

If you’re reading this article because you’ve had your identity stolen, there are a few steps you need to take. First, put a fraud alert on your credit reports. As soon as you do this, lenders will know that they should take extra steps to verify your information before they extend an offer.

Next, try to figure out exactly what information was stolen. For example, if your credit card was stolen, you’ll want to quickly contact your bank and ask them how you should proceed. You may also file an Identity Theft Affidavit with the IRS online or by phone. Depending on your specific case, local law enforcement may also need to be notified.

Each time you think your social security number might have been compromised, you need to contact the Social Security Administration (SSA). Even if there’s no evidence that it’s been used fraudulently, you need to notify the SSA so they can inform you of the steps you can take to protect yourself.

Common Types of Theft

There are many types of identity theft. One prominent type is tax- and wage-related fraud. Tax identity fraud occurs when an individual files a fake tax return with your information. Wage fraud takes place when someone poses as you to earn and collect your wages.

Financial identity theft means that someone is using your personal information for financial gain. So, if someone steals your credit card and purchases something on it without your knowledge, you’re a victim of financial identity theft.

For adults 55-years-old and up, medical identity theft is an all too real and serious problem.

A person who has Medicare may find that a criminal has used his or her information to obtain healthcare services. People who see mail or bills for treatments they don’t remember getting are sometimes victims of this type of medical identity theft.

Staying Safe

To try to keep yourself out of harm’s way, you can make sure you don’t carry your social security card in your wallet or enter it online. You may also choose to ignore requests for your personal information online and by phone.

Pay special attention to your billing cycles, and review your financial statements when they are released. All of your banking information should be password controlled and locked. Although it might seem overzealous, you can also review your credit report once a year to make sure everything is correct and up-to-date.

It’s also smart to install security features on your WIFI-enabled devices. After you sign in, make sure you’re on a private network. Each time you use public WIFI, keep in mind that you’re at a higher risk for identity theft. To the best of your ability, do not enter or access any personal information while you’re on a public network.

Another sound practice is to make sure you use a strong firewall and/or a virtual private network. A firewall is a network security system that evaluates your network traffic and helps keep out unwanted activity. A virtual private network can help your device send and receive data across public networks with the added security a private network offers.

Virus-detection software can also help you keep criminals away from your personal information. Generally, you want to sign up for a paid subscription for this service, as free versions are known to have several vulnerabilities.

Identity Theft Services

There’s only so much you can do on your own, which is why many opt to pay for a service to supplement their identity protection efforts. As discussed above, these paid offerings specialize in warning, monitoring, alerting and recovering.

Depending on your level of service, a company may help you avoid having your identity compromised and restore your credit if it ever gets into the wrong hands.

The best way to decide what service is right for you is to compare your options. See what qualities potential plans have in common and what sets them apart. You can even call a few companies to speak one-on-one with a representative who can tell you more about their specific offering and competitive features.

Protecting your identity may seem overwhelming and impossible, but there are concrete steps you can take to give yourself the highest level of security. If you don’t know where to start, consider reaching out to a friend and ask him or her what they’re currently doing to protect their information.

Depending on the answer, he or she might be able to steer you in one direction or another. If not, you two can begin to explore the offerings together to see what plans stand out amongst the rest.

A no-brainer place to start is with HelpCloud Tech Support membership, as each one comes with identity protection and restoration services through EZShield, a company that’s won “best overall” in identity protection solutions three times in a row.